Introduction

WhatsApp, a service owned by Meta, is preparing to transform the digital payment landscape in a big step to strengthen its position in the Indian market. In India, WhatsApp recently announced plans to integrate credit card payments and services from competing digital card payment companies. This tactical move attempts to increase its commerce products and meet the demands of its enormous user base, which numbers more than 500 million people nationwide. In this essay, we will examine the specifics of this fascinating development, as well as its ramifications and what they portend for India’s future in terms of digital payments.

WhatsApp’s Benefit

The decision by WhatsApp to expand its services in India was motivated by the enormous potential of this market. India has WhatsApp’s largest user population, with more than 500 million active users. However, regulatory restrictions had previously only allowed 100 million users to use WhatsApp Pay. This action makes it easier for a wider audience to accept digital Card payments.

Payments Made Through Apps

Prior to now, customers who were purchasing on WhatsApp could pay using third-party services like Google Pay, Paytm, and PhonePe. Users had to leave the WhatsApp site in order to complete these transactions, which was a hassle. By enabling payments through competing providers, such as those using India’s UPI quick money transfer system, straight within the app, WhatsApp has now made this headache obsolete. The payment procedure is anticipated to be smoother and more user-friendly as a result of this simplification.

Cards, both credit and debit

The updated features of WhatsApp now include in-app credit and debit card payment methods. Users now have even more options when making purchases through the site thanks to this addition. Whatever method of payment you prefer—digital wallets, UPI, or credit/debit cards—WhatsApp intends to accommodate all of your needs.

Growth Strategy for Meta

Mark Zuckerberg, CEO of Meta, has been outspoken about his desire for WhatsApp to play a major role in the company’s growth strategy. The urgency of increasing WhatsApp’s capabilities in India is increased by the difficulties that Meta’s primary advertising business and metaverse projects are facing.

Although the number of users for WhatsApp Pay is still limited, there are no such limitations when dealing with businesses inside of WhatsApp using other payment options. Businesses wishing to interact with WhatsApp’s enormous user base now have intriguing new chances to do so.

The Impact of UPI

Approximately 300 million people use India’s Unified Payments Interface (UPI), which now handles monthly transactions of about $180 billion. With the ability to accept payments through UPI, WhatsApp is well-positioned to participate in this enormous and vibrant ecosystem. This offers an alluring opportunity for companies to collaborate with Meta to gain access to WhatsApp users, potentially changing the way business is conducted in India.

Increasing the Business Horizons

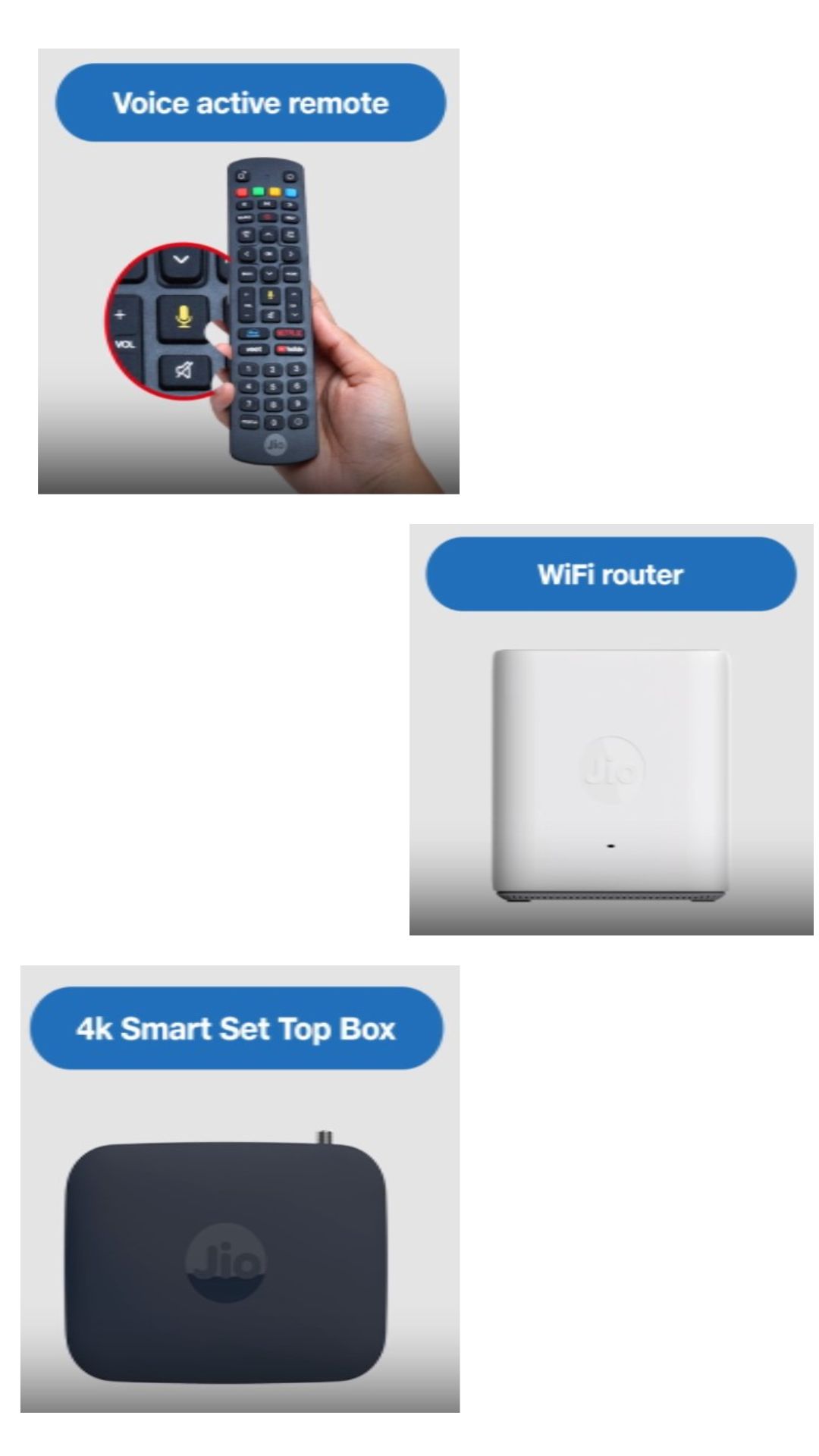

Up until this point, WhatsApp’s entrance into the Indian e-commerce market had only consisted of trial projects, including alliances with companies like JioMart. This announcement, however, denotes a considerable expansion. Any Indian firm using WhatsApp’s business platform would have access to the new Card payment facilities. This platform is predominantly used by larger organizations, underscoring WhatsApp’s dedication to acting as the primary location for business communications.

Program for Meta-Verified Subscriptions

Meta is growing its Meta Verified membership program for businesses worldwide in addition to its payment services. Companies can increase their visibility in users’ feeds and validate their validity thanks to this effort. This service will first launch on Facebook and Instagram in a few countries before eventually expanding to WhatsApp, giving companies a potent tool to improve their online visibility.

Conclusion

WhatsApp has taken a big step toward dominating the digital commerce landscape by deciding to accept card payments and providing services from competing digital card payment providers within its app in India. WhatsApp is poised to revolutionize how transactions are carried out in the nation thanks to its sizable user base, straightforward payment alternatives, and access to India’s booming UPI ecosystem. Businesses and users may anticipate a more seamless and interesting digital experience as Meta continues to develop and broaden its services.

FAQs

What is UPI and why is it important to India’s digital payments system?

In India, a real-time payment system known as UPI, or Unified Payments Interface, enables immediate money transactions between banks. It is now a vital part of the nation’s digital payments because of how convenient it is and how widely it is used.

How would WhatsApp’s growth help Indian companies?

Businesses now have the chance to connect with a large and engaged user base through WhatsApp’s development into digital payments and commercial interactions, thereby increasing their sales and online presence.

What does Meta’s Verified Subscription Program mean for companies?

Businesses can validate their accounts and increase their visibility on social media sites like Facebook and Instagram thanks to Meta’s Verified Subscription Program, which enables them to better interact with their target audience.

Are there any restrictions on WhatsApp Pay’s user base in India?

Yes, the initial WhatsApp Pay user base in India was set at 100 million. Other WhatsApp payment options are not subject to this restriction, though.

How can I use the new Card payment services and features in WhatsApp?

Make sure the WhatsApp app is updated and installed on your smartphone if you want to use the new Card payment services and features. Then, for a smooth transaction experience, explore the Card payment options within the app.